On foot of both NCB Manufacturing PMI and NCB Services PMI for Ireland for April 2013, let's take a look at underlying employment conditions signals from the two core sectors of the economy.

From the top:

Manufacturing and Services PMI readings continued to diverge in April for the 5th consecutive month, with headline PMI readings for:

From the top:

Manufacturing and Services PMI readings continued to diverge in April for the 5th consecutive month, with headline PMI readings for:

- Manufacturing PMI falling to 48.0 in April from 48.6 in March marking the second consecutive monthly sub-50 reading. 12mo MA is now at 51.3 and Q1 2013 average is at 50.1 so things are moving South for Manufacturing in recent months.

- Services PMI rising to 55.2 in April from 52.3 in March. 12mo MA is at 53.3 and Q1 2013 average is 54.2, implying PMI readings moving North for Services in recent months.

These trends in overall PMI readings were broadly repeated in the Employment sub-index dynamics:

- Employment index for Manufacturing slipped to 46.9 in which is significantly below 50.0 and marks second consecutive month of declines and sub-50 readings. In the last 6 months, index declined 4 times, but was below 50.0 only in two months. 12mo MA is at 51.3, but Q1 2013 average is 50.1 and this comes after 52.0 average for Q4 2012. So things are sliding and sliding rather fast.

- Employment index for Services, in contrast, posted a robust increase in April to 55.2 from 52.3 in March. April marked ninth consecutive month of employment increases being signaled by Services PMI, which is a good strong trend. Thus, 12mo MA is at robust 53.3 and Q1 2013 average is at 54.2 - a slower rate of growth on Q4 2012 average of 56.0, but statistically significant growth nonetheless.

Tables detailing employment indices changes below:

Manufacturing:

Services:

Now for the reminder: Employment in Services has far less tangible connection to actual sector activity than Employment in Manufacturing, with volatility-adjusted 1 point increase in respective headline PMI implying 0.67 units increase in employment index in Services against 0.87 units rise in manufacturing employment index over historical data horizons:

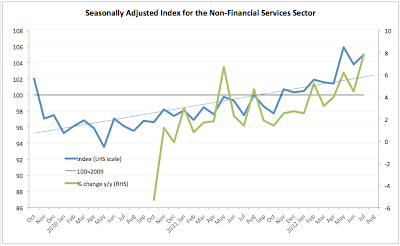

Click on the chart to see in detail the overall dynamics y/y for April in employment and PMI indices, clearly showing the switch between Services and Manufacturing in terms of the sectors' position relative to economic recovery. If in 2011 Services were a drag on growth and employment, while Manufacturing was experiencing strong gains, by 2013 Services became the core driver for positive momentum in both growth and employment, with Manufacturing pushing economic activity and employment down.